The pronounced shift in consolidator focus from platform acquisitions to brownfields, greenfields and single shops has opened the door for regional and multi-regional MSOs to grow more rapidly as acquisition values have somewhat cooled. The FOCUS Advisors team has been following the growth of these MSOs for nearly a decade.

“As we’ve seen the Consolidators gain huge market share all across the nation, we’ve also been following the growth of many regionally important MSOs,” managing director at FOCUS, David Roberts says. “There are now more than 150 MSOs across the US with 3 or more shops but of these, there are about 25 independent MSOs that are dramatically larger.”

In this article FenderBender and Focus identify some of these key MSOs and interview some of their executives.

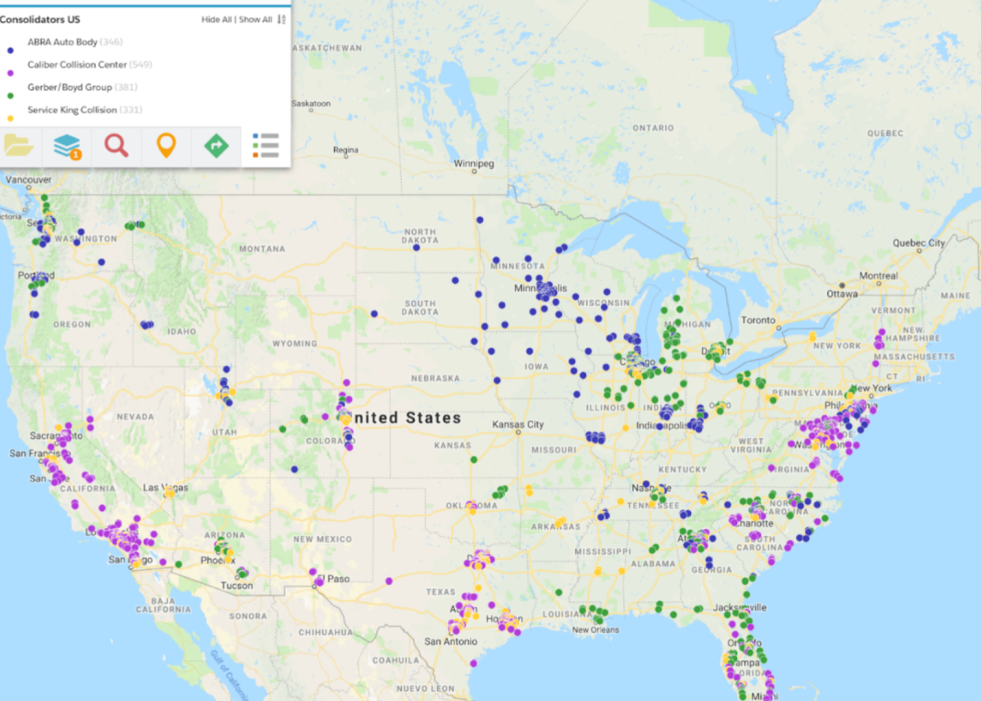

CONSOLIDATORS CHANGE THEIR FOCUS

After establishing a solid base of shops, qualified regional management and infrastructure, and strengthened insurer relationships, consolidators are now more focused on filling in their established markets.

For example, since acquiring most of the platform MSOs in the Washington DC and Baltimore markets, Caliber has been aggressively buying single shops and developing a steady stream of brownfield and greenfield locations. During 2015 and 2016, acquisitions of Pohanka, Craftsman, and other large DC region MSOs, Caliber created a base of 45 shops and more than $170 million in market revenues. Today, Caliber has more than 80 shops in MD, DC and VA with an estimated $300 million in revenues.

ABRA has paralleled this pattern with its platform base in Philadelphia, the former Keenan Auto Body, which it acquired in 2015. On this base of 10 stores, they have now grown to 25 with multiple additional targets across Pa. and N.J. Gerber has been the largest factor in the Chicago market since acquiring major platform CCA in 2015. These 45 shops are the foundation for nearly 60 today (59 as of September 2018, with ABRA at 37 and Service King at 33).

Most major metropolitan areas outside of the Northeast have effectively been penetrated by at least two consolidators, while three are present in 9 of the 25 largest MSAs (DC, Chicago, Seattle, Dallas, Phoenix, Tampa) and all four are present in four key markets (Atlanta, Charlotte, Philadelphia and Denver).

THE BIG REGIONAL AND SUPER REGIONAL MSOS

Many of the remaining large MSOs continue on their own impressive growth tracks. While most have had discussions with the consolidators, they have largely chosen a different path. Many have weighed acquisition offers they have received and found them wanting in value or culture or future opportunities. And most continue to earn impressive incomes from their operations and feel no financial pressures to sell. As one top 50 MSO executive commented, “As long as I can grow my EBITDA faster than values are falling, I’ll continue to invest and grow.”

While many industry observers and participants have been focused on the growth of the consolidators, we think taking a closer look at some of the largest and fastest growing MSOs reveals another form of growth and consolidation taking place beneath the surface of the Big Four.

Taking a closer look at these more rapidly growing MSOs, we categorize them as Super-Regionals and Regional Market Leading (City Dominant) and we enumerate their shop locations as of September 2018. In a future article, we will focus attention to the dealer MSOs which have largely flown under the radar for the past 10 years.

Super-regionals are super-sized operations with multiple geographic regions, large operations staff and capabilities, access to capital and impressive growth over many years. They include some of the best known operators in the industry including:

- Cooks Collision – 38 shops around Northern and Southern CA

- Joe Hudson’s Collision Centers – 80 shops throughout Alabama, GA, FL, TX

- Classic Collision Inc – 22 shops in GA

- Pacific Elite Collision Centers – 18 shops around Westside LA and Orange County

- Gates Collision Centers – 16 shops in Wisconsin

- Carubba Collision – 19 shops in NY

Regional Market Leading MSOs which dominate large segments of smaller geographic areas include:

- NuLook Collision Centers – Northern NY with 16 shops

- 1st Certified Collision – 8 shops around Inland Empire CA

- Seidners Collision Centers – San Gabriel Valley of Southern California with 14 shops

- LaMettry’s Auto Body – 9 shops spread across the Minneapolis/St. Paul area of Minnesota

- Moody’s Collision Centers – only large MSO in Maine with 11 shops

- Mike’s (Rose) Auto Body – 15 shops in Alameda and Contra Costa County of Northern California

- G&C Auto Body – 13 shops in Marin, Mendocino and Sonoma Counties of Northern California

- Collision Works Auto Body – Central Oklahoma dominant with 16 shops including expansion to Kansas City Missouri

- Schaefer Autobody – 11 shops in St. Louis Region

A LOOK AT THE DIFFERENT STRATEGIES

Success strategies are varied and diverse in this large MSO world. Scale has been key. Regional importance doesn’t come without growth, most often organic and also by acquisition. For some shops, buying a small MSO has enabled more rapid growth while others have added shops one by one, steadily over years. Others in this group focus on aspects such as the location or potential insurance partnerships, which can limit the amount of acquisitions but pay big rewards as repairable vehicle flows into existing shops begins to accelerate.

Although each of these large MSOs goes through a different process, all share the same goal: gaining scale and efficiency by adding more shops, adding more DRPs and increasing their ability to satisfy their increasingly sophisticated customer base. Three separate MSO operators discuss their growth strategies and how they’ve been able to successfully grow throughout the years.

1ST CERTIFIED COLLISION CENTERS

1st Certified Collision Centers, an eight-facility MSO located in the Inland Empire region of Southern California, acquires existing shops each time. Owner and CEO Bill Lawrence recounts, “We typically acquire existing collision businesses that are exiting due to either retirement or revenue, profitability changes. [We acquire] dealership space when the dealer focus is satisfied customers and not referral fees, and collision businesses that have shut down.” With 10 shops total, two of which were acquisitions, the business brings in a total of over $30 million in annual revenue.

“Our market has a substantial consolidator presence. Initially, our revenue was impacted negatively through consolidator service agreements with insurers,” Lawrence says. “For that reason, we joined in forming Certified Collision Group (CCG) as a means of achieving the scale necessary to negotiate national service agreements.”

Since joining the group, the business has felt confident in making larger shop investments. “With the help of CCG, we have expanded our DRP relationships and we can confidently open brownfields knowing that we have revenue sources,” Lawrence says. “And critical to CCG being positioned to provide insurer-based revenue support is that CCG as a whole must meet or exceed its KPI performance commitments. To date, CCG has done this with flying colors.”

JOE HUDSON’S COLLISION CENTERS

Joe Hudson’s Collision Centers, the fifth-largest MSO in the United States (by number of shops), has mastered acquisitions of all types, from platform acquisitions, like it’s recent acquisition of the 13-locations Car Guys in Florida, to brownfields, greenfields and single shops.

Traweek Dickson, president of Joe Hudson’s Collision Centers, prefers greenfield locations, he says, but it has its limitations for the shop. “It takes a long time,” Dickson says. “If you say, ‘Hey, I want to build a store in that marketplace,’ it’s taken us a solid year-and-a-half from the time we make that decision to the time we open that store.” Along with time, there are other obstacles these greenfield shops have had to go through due to faster growth.

“While there are not great stores for sale on every corner, the constraint has been out of ability to buy stores and get them running under the systems that we currently have,” Dickson says. “It has taken us 2-3 years to learn how to buy stores and to fold them into our system.”

CARUBBA COLLISION

Carubba Collision, a 19-facility operation, has been in operation since 1952. The MSO operation started as a family business owned and operated by brothers, Joe and Samuel Carubba.

According to Joe, the brothers split entities in 1997, taking on new roles: Joe, President and CEO of Carubba Collision Corp., and Samuel, President and CEO of Carubba Collision DBA.

Today, Carubba Collision Corp. is preparing to open the store’s 18th location this Oct., Joe says. According to Joe, the shops are typically brownfield, but the company has seen six acquisitions during its time.

“We are now spread out throughout New York state,” Joe says. “We go as far west as Jamestown and now we’re as far east as Albany.”

“We are really proud of the fact that we started as an old gas station and now we have a few hundred employees,” Samuel says about the family business.

Samuel operates three DBA Carubba Collision shops, and he says maintaining employees is big in his business. In addition to having employees stay upwards of 25 years at the company, his business has focused on building relationships with paint manufacturers and 20 groups, Samuel says.

“With those types of industry leaders that we’ve been able to familiarize ourselves with, befriend, [as well as] what we learn at those seminars to help run our business—we’ve been able adjust to change as well as look down the road to see where the industry is headed,” Samuel says. “At this point, we haven’t really considered [private equity partners] because of the success we have been able to achieve through the quality of the people that work with us.”

A LOOK AHEAD

“These regional and super-regional MSOs are distancing themselves from the large single shops and smaller MSOs by breaking through the scale barriers,” Roberts says. “They have controllers and CFOs, central office support teams, training and certification leaders and a bench of hungry estimators, CRMs and techs who want to move up, take more leadership and learn.”

“We at FOCUS expect to see some of these players grow much larger. Some are already accessing private equity, others will sell to a consolidator or other large regional but growth is in their DNA.”

Published in FenderBender Magazine August 2018: https://www.fenderbender.com/articles/11504-rise-of-the-regional-and-super-regional-msos