We often write about how consolidation is constantly creating new landscapes in the collision repair industry, one increasingly dominated by the largest MSOs. At the same time, many operators have grown their own organizations into strong super regional or regional MSOs with three to 75 shops. What is sometimes overlooked is the reach and sophistication of franchisers and Affinity Plus groups as they grow their offerings and networks.

These franchisers and affiliation groups are gathering places for like-minded entrepreneurs, determined to grow their businesses and stay independent—but exist within a system that provides more support and benefits than continuing to do it on their own. Each of these “tribes” confers benefits and, in return, generates fees from its members. Some are of long-standing establishment and others are more recent.

FOCUS Advisors is a group of deeply experienced professionals dedicated to serving automotive enterprises from collision repairers to paint and parts distributors to auto dealers, in raising capital, mergers and acquisitions and strategic partnering. The Group has represented collision industry companies in more than $250 million of Mergers and Acquisition transactions in the last five years.

FOCUS Advisors’ Managing Director, David Roberts, recently surveyed these tribes and interviewed some of their leaders to learn more about how they are each helping their shops to grow, thrive, and to learn more about their offerings and strategies.

THE TRIBES

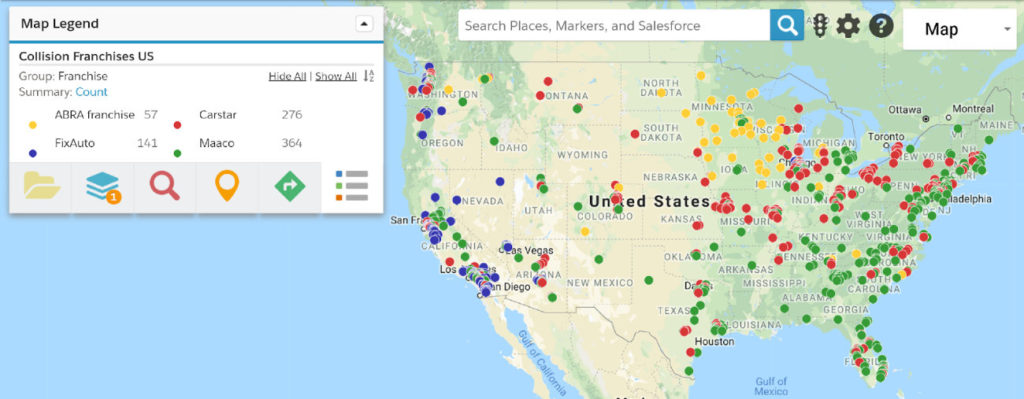

Among true franchisers there is a “Big Four” of sorts—FixAuto, CARSTAR, MAACO, and ABRA. (Yes, ABRA! Or should we now say Caliber? There are almost 60 ABRA/Caliber franchisees including some MSOs). Collectively, these operations franchise more than 900 shops, from $1 million paint operations to $35 million MSOs, and generate more than $1.4 billion in revenues.

The two leading Affinity Plus groups are Certified Collision Group (CCG) and 1Collision, with more than 300 shops and $1 billion-plus in combined revenues.

In our analysis we compared their total members, estimated revenues, and primary offerings as a way of helping operators learn more about the “grow and thrive” opportunities that exist just outside their shop doors.

| Entity | North American Shops | System Revenues* | Offerings | Owners |

|---|---|---|---|---|

| FixAutoUSA | 141 | $350 million | Insurance representation; information transparency; collaboration | Private |

| CARSTAR | 323 | $600+ million | Operations platform; vendor discounts & rebates | Driven Brands |

| MAACO | 488 | $450 million | Brand recognition; proven turnkey business model; training & support | Driven Brands |

| ABRA/Caliber | 59 | $150 million | National brand; insurance partnerships; proven process & tools | Caliber Holdings |

| CCG | 270 | $1+ billion | Business development; sourcing partnerships; insurance partnerships | Private |

| 1Collision | 51 | $100+ million | Network brand; marketing, financial, & HR systems; operational training | Private |

*Estimated

MAP OF THE BIG 4 FRANCHISES

CARSTAR advertises itself as the largest MSO in North America, which is an accurate statement due to its total locations because it includes Canada. Domestically, they are still the largest franchiser with more than 320 shops in their US franchise network including several MSOs. Dave Foster now heads the CARSTAR franchise development team.

FixAuto USA, with a footprint largely in the western US., has driven revenues with its insurance DRP contracts, many of which parallel those of the other members of the Big Four. Former Mitchell executive Paul Gange has been leading the company for the past nine years.

ABRA/Caliber’s 60 shops are well behind MAACO in numbers, with estimated revenues of approximately $150 million.

CCG is the brainchild of some very successful California operators and marketing experts. In less than four years, they aggregated nearly $1 billion in revenues in their affiliation model. Industry veteran Bruce Bares heads up CCG.

1Collision, headquartered in Milwaukee, Wisc., is steadily building its affiliation network under the direction of founder Jim Keller.

Let’s learn a few things, shall we?

DAVID FOSTER, CARSTAR, AND THE POWER OF ADAPTABILITY

David Foster is the vice president of franchise development at CARSTAR North America. CARSTAR has 300-plus U.S. body shops that generate roughly $600 million-plus million in revenue. CARSTAR is a franchise organization and makes its money through revenue driven via sales and franchise fees.

“We want to create more profitable body shops throughout the continent,” Foster says.

With main offerings of operations platforms, integrated training, and vendor discounts and rebates, Foster believes much of CARSTAR’s success in the collision industry is driven “by scale and success.”

“We’re looking for good, strong partners in strategic markets to add to our location and to scale our network,” he says.

“Consolidators [such as ABRA and Caliber] are retooling and kicking up acquisitions, and we’re in the same place. We’re a family-based business, so we have to do it slightly differently.”

What does that mean?

“It means we really believe in the independents,” he says. “We believe there’s space for them, and we’re there to support them and augment their local/regional brands from a few different perspectives—not only in the name on the outside of the shop, but from the insurance side and national procurement and resources.”

Foster wastes no time detailing the keys of CARSTAR’s success.

“Our operational platform is the key to our structure. The platform is critical. Being able to elevate and compete with a national organization or brand is what we aim to do for even the single shop owner. To sustain the business you have but improve both the top and bottom lines. With a shifting margin, there’s a natural squeeze in profitability. We are helping [shop owners] find ways to maintain their margins and also improve to improve them.”

What does that look like to an average driver coming through the door?

“One key thing we really help with is customer satisfaction,” Foster says. “Our NPS score is the highest-rated in the country. The insurance companies want retention too—a high level of satisfaction maintains that relationship. As a nationwide network we have the highest NPS score. It helps our brand and franchise partners sustain and grow. We know the power of the local businessman and businesswoman—the power of independent owners—is a real difference. They connect with their communities in ways corporate employees never could.”

As any business owner knows, however, things don’t always go as planned. Shops often are forced to close their doors despite implementing best-practice business plans. How does CARSTAR mitigate conflict and loss?

“Good question,” Foster says. “Do stores get sold? Sure they do. But we have a 95 percent retention rate on renewals. Our franchisees are getting stronger; our numbers are sound. There’s no panic about what’s going on with consolidation. From a store standpoint, our partners are continuing to organically grow. They’re looking to add locations.”

How did CARSTAR adjust to the recent ABRA/Caliber consolidation?

“We didn’t adjust tremendously. Our three-year plan is 1,000 locations in our network. Five years is hard; we’ve shifted our yearly outlooks from 10-5-1 years ahead to 3-2-1 because the industry is changing so fast. Consolidation creates opportunity. We’re excited about the program and its future. We’re excited about our place in the collision repair industry; if you really stop for a moment and look at the industry, it’s changed as much in the past 10 years as it will in the future. This industry keeps you on your toes and alert, and you have to think preemptively. It’s the only way to survive.”

What’s next?

“More CARSTAR out there. More exposure in the trade publications and trade shows. You’ll see a lot more excitement. Our conference is in Chicago and our theme is Acceleration. Last year our theme was Momentum. We’ve built enough momentum, but the moment is now, and we need to accelerate our growth.”

To that end, what are your best targets for new members?

“We don’t shy away from anything. We like the single-store guy with a business plan who is looking to grow. Small, regional MSOs and dealerships are also part of the plan. We’re doing well in Canada and we need to do better in the United States. But we’re in play with whoever you are—a single shop owner, MSO, or dealership—and we want to grow with all of them.”

What’s the largest challenge facing single-store owner today?

“Staying relevant,” Foster says, “and continuing to consolidate. Demand a single point of contact with vendors and insurance companies. Keep up with the changes through the continuous technical/training aspects of the automobile. It’s very expensive for an independent, and through CARSTAR University, we empower them to stay ahead of the curve on the training side for all their employees. We’re at the table with all the OEs discussing the changes and that allows our stores to stay ahead of the curve.”

PAUL GANGE, FIXAUTO, AND THE POWER OF ACCOUNTABILITY

Paul Gange has been president and CEO of FixAuto USA since 2009. FixAuto converted into a franchise business in 2011, and most of its shops are in the western U.S., as well as Illinois, and blanket the West Coast from Mexico to Alaska. FixAuto has almost 150 shops in total and does about $300 million to $330 million in annual revenue.

“We’re better together than apart,” Gange says, “lock arms and move ahead.”

How do you get shops on board with that motto?

Gange pauses.

“Our business is an interesting one,” he says. “Over the last 20 years and definitely over the last 10, the industry has shifted to favor those organizations that can provide a certain level of shared management or self management, delivering loss-adjustment expense savings back to carriers. It’s critical—you can’t do that if you’re standing alone. You have to be part of something bigger than yourself.”

Gange says shops join FixAuto due to three distinct and interrelated factors:

- The ability to grow—access to conversations, contracts, and the data and foresight that those conversations provide

- The power to buy better—buy better, buy together, and attain margin improvement opportunities through group contracts

- The mindset and business knowledge of a like-minded community of entrepreneurs

“That’s the most important,” Gange says, “and most unanticipated! Our partners gain massive benefits from the communities they contribute to. Together, we celebrate success, learn from one another, and develop best practices that can grow equity and, grow profitably.

“That’s the simple 1-2-3.”

How does FixAuto distinguish itself in a busy marketplace?

“I think one thing that’s different for FixAuto than others that offer network-type programs is this: FixAuto franchisees demand market-leading performance from one another—we’re working with multi-generational owners. Many have always been kings of their own castles. But they all yearned for accountability! They wanted someone to hold their feet to the fire. We position our shops and accounts to depend on one another as if they worked for one another, because they do. Two or three shops will help solve a problem—lend a hand, lend a tech—far before any upper-level management needs or should get involved. That allows us to compete.

What does that look like?

“In some markets, for example, we hold business councils. We bring estimators, general managers, painters (painters!)—on a roundtable basis. We want whoever touches that shop in that community to have a voice. They can’t always contribute, but they’re evaluating performance not only at the owner level but at the estimating level, the mechanical level. Transparency is key and creates a best-practice situation and energy, and that yields high-level performance results. We’ve got a lot of eyeballs and brainpower when we bring shops together.”

So a rising tide raises all ships?

“Absolutely. I’m passionate about it. Characteristically, our shops are defined by four common personality types—as goes the owner, so goes the shop. We look for ownership that’s passionate about the business, owners who are still interested and like what they do. We look for owners deeply engaged in their business, owners who are ready to learn, who come to work every day and look for opportunities to make their shops better. We look for shops that are super competitive—that’s why we’re transparent in our performance recording. Finally, we look for drive—how driven is the shop? Do they want to grow? Do they want to get smarter?”

Gange pauses.

“We can help them,” he says. “We want to help them.”

What are your best targets for new members—single shops? MSOs?

“We acquire MSOs in our franchise organization, yes. The largest has nine locations, a few have five or six, and a few with two or three. We work very closely with our shops to grow. We give them preference on territory and preferential pricing to expand. We celebrate success and failure equally. You learn from every step you take.

“The risk goes way down when they join our organization and want to expand. They have great best-practices. They have a community to support them. It’s a great way to expand locations. Last year over one-third of our newly reported franchisees were expansions.”

Will FixAuto change its practices after the ABRA/Caliber merger?

“Changes? No, not really. There’s a few ways to look at it. That consolidation didn’t add any stores to the marketplace—we’ve been competing against that entity for a while, just like everyone else. We believe our business model and our offering remains as strong if not stronger than ever before.

“If consolidation wasn’t obvious before than it should be now; consolidation is here to stay. Big will get bigger, and those who stand alone have a much greater risk. We’ve been telling that story for a decade or two at FixAuto. We are structured to compete very effectively against any organization of any size. We outperform them today and we’ll continue to outperform them.

“As measured by those that provide the data for carriers, OEMS, etc., in the critical areas, we stand above in cycle time, throughput, total cost, customer satisfaction, quality, vehicles delivered on time. All the categories that get measured independently from Enterprise, CCC, etc., we get blind reports but see our level relative to others in the category, and we are elite. It’s all proprietary, of course—competitors are redacted, and they’re getting the same reports.”

What about the future? What’s the five-year plan?

Gange laughs—“David is right,” he says, referring to the 1-2-3-year outlook David Foster mentioned regarding how CarStar looks to and measures its present and future.

“One-two-three is very well said. We just don’t live in those times anymore, to David’s point. We’ve built a solid infrastructure to support growth. We’re systematic and process-oriented in such a way to sustain growth, and to do that efficiently. Our shops and owners don’t need to worry about knee-jerk reactions from their parent company.

“We believe there’s growth opportunity,” Gange says.

“The times have never been better for shop owners. We’re very cognizant of the pace of change. We’ve always been a nimble organization, and we stand upon a very solid structure and foundation.

“We believe that we work well because we work together. I don’t look at franchisees as working for me and vice-versa. We all work together. We tell prospective franchisees to pick up the phone and call current and former ones. We happily provide references. We want them to work together. They’re competitors today, but tomorrow they’ll have to be cooperators. It’s remarkable—by the time you figure out over time that you’re on the same team, it’s incredible how much we can learn from another and enrich the mutual opportunity. We welcome that.

“It’s characteristic of who we are. We’re better together than apart. Lock arms and move ahead—my job is to facilitate that. We want shops to play that game, look ahead, and want to kick some ass.”

JIM KELLER, 1COLLISION, AND THE POWER OF COMPREHENSIVE SUPPORT

Jim Keller is the founding owner of 1Collision, a 51-shop operation headquartered in Milwaukee, Wisc. 1Collision has been growing its affiliate network for years and see $100 million-plus of annual revenue in its shops. 1Collision offers a robust network brand, marketing, financial, and HR system support, and extensive operational training.

Keller wastes no time describing 1Collision’s reaction to the ABRA/Caliber merger.

“They repair collision-damaged vehicles, and we repair collision-damaged vehicles,” he says.

“People come to shops under trauma from accidents. There are many similarities. The difference, however, is that organizations like the Big 3 (ABRA/Caliber, Gerber and Service King) and MSOs like 1Collision—we have resources that allow us to enhance employee benefits, resources, and experiences, that many single-shop owners don’t have time to implement, especially on the HR side. We do a lot of HR resource development—retention, recruiting, benefit packages. The average shop may struggle to do that. We have an incredible HR solution to collision damage.

“When you look at what a collision shop owner has to be knowledgeable about today, it’s very intimidating. Big shops have dedicated employees to help with this. For a single shop owner to do this is very difficult. But we provide corporate-level support to body shop owners in our network. When they have that, everything else is ‘fixing wrecks and collecting checks.’ ”

Keller describes the extracurriculars many newer shop employees expect from their employers.

“Everybody wants benefits,” he says, “and it’s complicated. Shops that don’t have benefits may struggle. But what is a benefit? A benefit is over and above what everyone else offers, above and beyond two weeks of PTO. It’s insurance, 401k, wellness programs, signing bonuses. And that’s new! That originated with the consolidators. And we can offer that—it takes a team of fourteen people for forty-five shops. That’s what we do. Who can afford that at a smaller basis?”

He pauses. “It takes an army.”

Along with a generous benefit package, how does your enterprise attract new franchisees or affiliates?

“1Collision provides corporate-level support to the independent and dealer-owned single- and multiple-location collision repair businesses. Comprehensive corporate support includes organizational, operational, marketing, financial, and HR assistance.”

That’s why he’s confident 1Collision will compete in an increasingly crowded (and competitive) market.

“Our model accommodates all shop models, from smaller single stores in more rural areas to mid-sized and large stores in more densely populated areas. We have dealer shops and MSOs in addition to single stores in our network, and have many value-added offerings for each of them.”

Now that the dust has settled a bit from the ABRA/Caliber merger, where does that shops like 1Collision? What’s the new market look like?

“When the news was announced, I don’t think many in the industry were really surprised that it was going to happen,” Keller says.

“When you think about it, two large groups totaling almost one thousand shops merged together, and there’s not one more shop than there was before,” he notes, laughing. “It’s just the Big 3 now instead of the Big 4. At the end of the day, when those mergers occur, sometimes relationships—particularly among insurers—don’t always travel from the acquirer to the acquiree.

“To me, that’s the biggest disruptor. Each company had a CEO, a CFO, and in these mergers, it behooves them to make some of them go away. If you can drop those high-level employees, you cut costs relating to high-level management. Those organizations see the most change at the top level. At the store level, it’s business as usual.”

He says it may not disrupt business at the shop level as much as some may expect. “They’ve been through it before—they just keep coming to work at the same place, though their paycheck issuer may change.

“Some of the questions are: how is the branding going to work? Will shops remain with the same brands under one corporate umbrella, or will they shift? We have shops in a number of markets that ABRA is in but we only have shops (to my knowledge) in one market where Caliber is in, and that’s California. If their name is going to switch to Caliber, there may be some confusion for the consumer, but at the end of the day, there weren’t any more body shops than there were before. It’s two consolidated organizations coming together as one. For power, it means the new group has more purchasing power, but they were already top of the shelf.

“Your average independent shop or dealer shop won’t be hugely affected. The long-term ramifications of a new merger (my calculation is something like 1,000 shops averaging $2 million apiece is $2 billion in sales. Let’s say it’s a $30 billion industry in collision repair—they’re pushing close to 10 percent market share.)

“No one’s ever had that. The Big 4 had 25 percent before, and now ONE has 10 percent. That’s no different from hardware or supermarket chains—they’ve all been through that. Being able to buy products, parts, services at an incredible discount will certainly matter—their margins have been scrunched.

“But I don’t know what happens to their purchasing power when they’ve already squeezed the market. How much more can they contain their costs with their purchasing volume by doubling their size? Suppliers found a way to reduce their costs; to give anything more could be difficult,” he says, laughing again.

“There’s no more juice left in the lemon. When you’re No. 1 and you can’t lower costs, what else is left? Drive revenue. They’ll be able to capture more market share.”

In five years, Keller expects 1Collision to be at 200-plus locations with strategic insurer and OE relationships, positioning 1Collision as a strong, supportive network that repairs vehicles properly, utilizes contemporary and state-of-the-art OE procedures, and creates a predictable, positive experience for the consumer.

“I emphasize OE relationships and the use of OE procedures,” he says.

“That’s the most prolific thing happening right now—the conversion from where we were just a few years ago from shops not scanning nor understanding new technology. Insurance policyholders making renewals are a year behind—they base next year’s rate on the year before’s losses. When the industry isn’t scanning because no one told them they have to, there’s a number of shops that are now scanning—and that adds $400, $500 as a result to that scan. The insurance companies were not prepared with their premiums to pay for that. So we’re a year behind! The insurance companies end up having a fifteen percent increase, yet their premiums weren’t based on dealing with that technology. It’s almost a two-year cycle to to normalize. Consumers and shop owners need to remember that insurers don’t just have an open checkbook—they too have a responsibility to manage their costs.

He pauses again. “It’ll take 3-5 years for the technology, insurers, shops, and consumers to normalize and scale.”

Keller believes the future of driving in America (and the collision repair procedures that go along with it) is AI technology—SmartCars—whether drivers want that or not.

“5G thinking in AI is on the way,” he says, “and it’s incredible. The robotics will just become unbelievable. Some of that is going into the automobile as well. The cars will memorize the most common streets, turns, speeds, everything.

“Independent dealerships are declining. There will be a reduction in claims. There’s no doubt about that. The shop of the future will be aligned with fleets such as Uber and Lyft. The fleet and the manufacturers will get more into vehicle-use programs instead of selling the car, and people will rely more on public transportation.

“Everyone wants to get there quicker today—car crashes will go down and severity will go up due to autonomous technologies. Repair costs have already jumped from an average $2,500 to $3,500. There will be less cars to fix for more money.”

Will autonomous vehicles ever rule the road?

Keller offers his final laugh. “I’ve heard rumors,” he says, “but everyone does. It’s going to be a long time until the average American consumer takes their hands off the steering wheel. But it’s coming—the prevalence of AI / hands-free driving is already available at your local dealership in 2019.”

“Have you seen the self-parking cars? They’re incredible! The computer and cameras read the road, the vehicles in front and behind, and start making minute adjustments. The front and rear tires are exactly ten inches from the curb, and you’re perfectly positioned between two vehicles.”

BRUCE BARES, CCG, AND THE POWER OF SCALE

Bruce Bares is president and CEO of Certified Collision Group (CCG). CCG sees over $1 billion estimated revenue annually and counts over 270 shops in its primary network spread among 38 states.

“That’s the first thing to know,” Bares says. “We’re a network, not a franchiser.”

Bares says CCG helps affiliates improve their bottom lines by leveraging scale. From a small MSO to a single shop to a dealer, as long as you’re OE-certified and referred to CCG, “you can join our network and take advantage of the benefits of the group,” Bares says.

Those benefits include everything from shop floor products to SEO optimization services, insurance representation, and more.

“Any of the items you don’t have the staff [or resources] for, we can help you,” he says.

“The benefits go beyond what [shops] need to work on cars. We try to help with everything from workers’ comp and general liability insurance to pricing, credit card swipe machines, discounts on shop goods and needs. Our staff focuses on everything. We improve both the top and bottom lines and shrink the margin significantly, and help our affiliates compete with the Big 3.”

“Copy paper to sand paper,” Bares says, laughing. “It’s a very simple model.”

“Leveraging scale”—what does that mean?

“It means if you have a consolidator in your market (or even if you don’t) and you’re competing with the guy down the street, you’re both trying to hire the best employees. If you’re just a single shop owner, though, you’re at a disadvantage due to scale. We can help even that field—that’s our goal.”

What’s the three-sentence “elevator pitch” to attract new affiliates?

“The caveat is we do not cold-call; you have to be referred us by an existing CCG affiliate or a vendor/partner of ours or an insurance partner of ours.”

Like the other subjects of this article, Bares is excited about the future, even—and maybe especially—in view of the recent ABRA/Caliber merger.

“My own personal feeling is that it will strengthen the need for scale,” he says.

“[The merger] is going to identify opportunities that we don’t see today because no one had that type of scale before; now that that group is so large, we’ll see what added benefits or advantages they’ll be able to drive based on their scale, which will then help others in the industry follow suit.”

Inevitably, however, that will leave gaps to fill—gaps that Bares is confident CCG will be able to take advantage of.

“I think you’re spot on,” he says. “When we look at why CCG was started—we’re close to 300 locations, next year at close to 500—we would have been able to offer everything they’ve been able to offer based on scale. Now that the merger exists, they’ll create a whole new dynamic in the industry about what you can drive based on scale. It’ll create opportunities for us. It’ll take us another four years to get to 1,000 shops and they already have that number—others will have a greater challenge trying to compete with that size without some sort of merger. But our opportunities look very bright based on our ability to scale so quickly. The low cost of entry for CCG from a shop owners’ perspective—it’s very exciting.

“I heard the same from my peers in the industry,” he affirms. “It’s very positive. It’s great to see the industry looking at the positives and change with the times.”

What’s the process to join CCG?

“If you’re OE-certified and referred to us, we will walk you through the application and sign an NDA for access to KPIs. We will build a scorecard or snapshot of your facility. We’ll review that and interview insurance partners and/or jobbers, and try to understand who you are in your community and how long you’ve been in business, and what your succession plan looks like. If you pass all of that, we’ll offer you a contract. That can all happen within a week or so. It really comes down to who’s referring you. If an affiliate refers you, they’re vouching for your credibility. It’s much easier to bring a partner on when you have someone feeling responsible for your performance.

“We don’t have the financial requirements to run our business like others who may have different standards for bringing on relationships. Ours is based on: Can you perform? Do you really need us? Can we help you? And is this going to be a long-term relationship?”

How does CCG make its money?

“We have two revenue streams. One would be a nominal membership fee on a monthly basis (it’s a flat fee per location; we do not share in their revenue). We also share in earned rebates with the affiliate. Where I think we come across differently is over 75% of our affiliates are literally on a positive cash flow with us on a monthly basis; they don’t pay us anything and they receive rebates in return that they may not have an opportunity to get as a single operator or MSO. Our size allows us to negotiate on prices for products or services they’re currently using, which offsets their fees to us in other areas. It puts us in a unique position. It goes to the mission statement of the founders: if we’re not able to help the shops at a low cost, then there’s no reason for us to exist. We challenge ourselves with that every day.”

Collective accountability is key to succeeding with CCG.

“Franchisers today help owners succeed in their business model. Our model is different in the fact that you need to be able to run your business successfully to be our partner. That’s a big differentiator. You’ve built a reputation in your community; you’ve leveraged your name over 10, 20, 30 years, and you’re committed to that. We allow you to keep that name but acquire the benefits of scale.”

As cars become more complicated and the ever-shifting automotive repair landscape changes, how will CCG respond?

“We have a whiteboard goal of 1,000 shops in four to five years. It comes down to making sure our offerings evolve with the needs of the repairer. As the landscape shifts—referral sources, where technology goes, what the OEs demand, where healthcare and some of the other aspects of running a shop go—we have to make sure that we adapt and adjust to the needs of our affiliates. If we can do that, 1,000 shops is not out of the question.

“Technology is going to bring the needs of the consumer to the forefront. You will see—and GM is maybe furthest down this path—you will see one single datebase across multiple platforms to help their consumers have their vehicles repaired safely. Once we get through this—it may be a bumpy road—I believe there will be harmony between the OEs, the insurers, and the quality repairers. That’s going to create great opportunity for the guys that don’t really fit the niche for certification. There’s going to be a place for OE-certified shops and a place for non-OE-certified shops. They’ll both be able to thrive and technology will be the driving force for that, and the consumer is going to win.”

Bares pauses.

“It’s coming quickly,” he says. “Right now, the collision repairers are not prepared. It’s going to take publications like yours and your peers to somehow reach those people and get them concerned about what the future holds for their success and their livelihoods. There’s a collaborative effort between my peers in the industry to work together to help educate the masses to help everyone move forward instead of infighting among splintered groups of repairers, manufacturers, and ancillary industries.”

GROW AND THRIVE WITH A TRIBE

If there’s one takeaway from these four success stories—one stressing adaptability, one accountability, one top-down support from boardroom to shop floor, and the last the power of scale—it’s that success begets success, and it’s easier to succeed together than apart.

The future looks bright.

Published in FenderBender Magazine December 2018: https://www.fenderbender.com/articles/12101-grow-and-thrive-with-a-tribe