David Roberts, Managing Director of Focus Advisors (focusadvisors.com), comments on the many acquisitions and openings in the first half of 2022. Originally a co-founder of Caliber Collision, Roberts has led multiple MSO and paint distribution transactions including last year’s sale of Quanz Auto Body to Crash Champions. He can be contacted at [email protected], 510-444-1173.

State of Play July 2022 – The Calm Before the Storm?

The first six months of 2022 have been an unusually slow period for acquisitions by most of the consolidators. Aside from catching their collective breaths after a frenetic wave of closings at the end of last year, there isn’t a single explanation for the slow down but general industry conditions experienced by every operator have put more of a focus on current production rather than future growth.

Extreme parts shortages resulting in significantly longer cycle times, an even more severe shortage of qualified technicians to do the work, and the increasing imbalance between insurance reimbursement rates and operator costs, have left every organization scrambling, improvising and struggling to meet current demand.

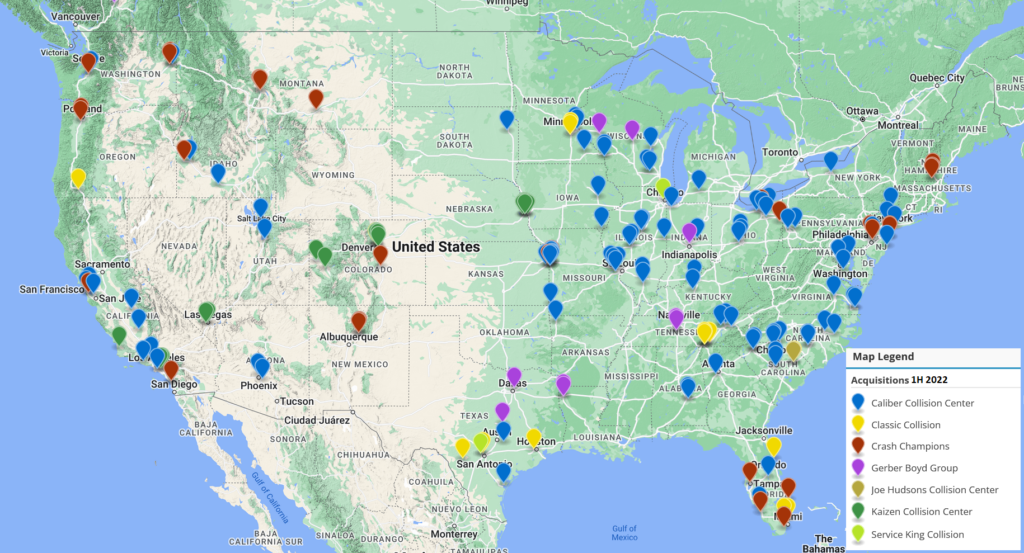

Consolidators

COVID has not slowed Caliber down. With more than 130 acquisitions and 72 brownfield and greenfield openings in the same period, Caliber grew more than 200 locations in the first six months of 2022! The company continues to shift its expansion focus to greenfield and brownfield openings. Of their total expansion efforts during 2022, we expect that more than half will be acquisitions.

Gerber (Boyd Services Group) slowed its pace fairly dramatically in the first half with fewer than 14 new locations compared with a whopping 48 in the first half of 2021. Combined with disappointing financial performance that impacted the share price of Boyd Services Group, Gerber has moved more cautiously in 2022.

Service King – The recap by Clearlake Capital

Service King opened two greenfield locations – one in the Chicago area and the other in San Antonio – but otherwise made no new acquisitions.

The continuing saga of Service King’s financial problems has finally been brought to an end — or at least an intermediate conclusion. Under the terms of a deal announced in June, Service King will receive $200 million in new capital and reduce its debt by over $500 million while extending its remaining existing funded debt maturities until June 2027. When the deal is completed, the full equity and debt positions of the parties will be more visible, but the new control entity is clearly Clearlake.

HOLD the Presses! Crash Champions is merging with Service King! The deal is scheduled to close at the beginning of August with Clearlake Capital Group as the investor. Service King’s 336 locations would combine with 225 Crash Champions locations Their combined footprint of shops will establish strong market shares in Texas, the Pacific Northwest, Florida, Washington, DC, Philadelphia, and Chicago, forming the third largest US consolidator. We will publish a separate and extensive report with more details and analysis of the transaction.

Biggest transactions

Crash Champions has continued its breakneck pace of acquisitions with the recently announced acquisition of Mike’s Auto Body, one of the largest remaining independent MSOs in the US. With 17 locations in SF Bay Area, Mike’s Auto Body is a key platform for Crash’s continuing penetration of the CA market. This acquisition followed more than 30 transactions by Crash in the first six months of the year. As of June 30th, Crash appears to be operating more than 203 shops.

In another notable transaction early in 2022, Mahnke Auto Body with its 8 locations in Colorado joined Kaizen Collision which now operates 15 locations in that state. CEO Sam Mahnke has been announced as the regional operating executive. Kaizen continues its rapid expansion with a technician-centric approach to operations. Its total shop count at June’s end was 51 shops.

Classic Collision

Classic continued its steady growth with an additional 16 shops in the first half including Pro Quality Collision in Florida and Crystal Lake Automotive, each with 2 shops.

CollisionRight

In late 2020, the Dallas-based private equity group CenterOak formed CollisionRight. Since its founding under the leadership of CEO Rich Harrison, the company has been on an acquisition tear. In the first half of 2022, they acquired Select Collision Group, which operates four shops in Pennsylvania. CollisionRight now operates at least 62 shops in states in the Northeast and the Midwest.

New Players

VIVE Collision, formed by former H&V Collision CEO Vartan Jerian and former private equity investors Scott Leffler and Phil Taub, has been acquiring in the Northeast US with two significant transactions in 2021: Crown Collision, a 3-shop MSO in Rhode Island, and POC Collision Repair Centers, a 4-shop MSO in Maine. So far, VIVE has acquired 4 shops in 2022 and expects to end the year north of 20 total shops.

CA Growth Vehicles

Having beefed up its executive team and examined multiple targets, Chilton Carstar now operates 15 total locations in the SF Bay Area along with one in the LA Basin.

G&C Auto Body, the largest independent MSO based in Northern California, acquired 4 new locations in the first half of 2022 and now operates a total of 26 locations with announced plans for 3 additional openings over the third quarter.

Under the Radar

Three new PE-backed groups are in the process of acquiring their first platforms. They will be disclosed after closing their acquisitions. We expect more new entrants to come into the industry during the remainder of the year as the appetite for resilient, cash-flowing businesses increases.

Total Acquisitions*

| Consolidator | Acquisitions | Brownfields & Greenfields | Total New Shops |

| Caliber | 130 | 72 | 202 |

| Crash Champions | 30 | 0 | 30 |

| Classic Collision | 16 | 0 | 16 |

| Kaizen | 16 | 0 | 16 |

| Gerber | 6 | 8 | 14 |

| Vive Collision | 4 | 0 | 4 |

| CollisionRight | 4 | 0 | 4 |

| Service King | 0 | 2 | 2 |

MSO Acquisitions*

| MSO | Shops | City | State | Acquirer |

| Mike Rose’s Auto Body | 17 | San Ramon | CA | Crash Champions |

| Mahnke Auto Body | 8 | Denver | CO | Kaizen |

| Great Plains Auto Body | 5 | Omaha | NE | Kaizen |

| Select Collision Group | 4 | Mechanicsburg | PA | CollisionRight |

| Gate City Collision Centers | 3 | Nashua | NH | Crash Champions |

| A Good Shop Auto Body & Paint | 3 | Northglenn | CO | Kaizen |

| Cable Dahmer Body Shops | 3 | Independence | MO | Crash Champions |

| Schaller Jacobson Collision | 3 | La Crosse | WI | Caliber Collision |

| Jost Collision & Garage | 2 | Neptune City | NJ | Crash Champions |

| CBS 1Collision | 2 | Shreveport | LA | Gerber Boyd Group |

| Elite Autobody & Paint Works | 2 | Springfield | IL | Caliber Collision |

| Collision Pro – MT | 2 | Helena | MT | Crash Champions |

| Syrena Collision Center | 2 | Montgomeryville | PA | Crash Champions |

| Autobody Advantage | 2 | Spring Hill | TN | Gerber Boyd Group |

| Pro Quality Collision – FL | 2 | Fort Lauderdale | FL | Classic Collision |

| CARSTAR Tony Kempen | 2 | Plover | WI | Gerber Boyd Group |

| Pesicek Collision Centers | 2 | Oconomowoc | WI | Caliber Collision |

| Melvins Collision Plus | 2 | Benton | MO | Caliber Collision |

| Steve’s Auto Body & Repair | 2 | Ford City | PA | Diehl Automotive |

| Crystal Lake Automotive | 2 | Lakeville | MN | Classic Collision |

*Any acquisitions or counts of acquisitions are based on the best estimates of Focus Advisors.

Why are Private Equity firms so interested in the collision repair industry?

While there are multiple reasons why large pools of institutional capital are attracted to the collision repair industry, the overriding reason is Sustainable Cash Flow. In good times and bad times, businesses with historically positive cash flows are attractive to large pools of capital whose primary objective is more predictable returns and lower risk.

The Ubers, Airbnbs, and other tech darlings whose shares have plummeted over the last three months don’t generate cash; they burn cash – billions of dollars of cash. Investors in these kinds of companies are not seeking stability. They are seeking hypergrowth and for much of the last decade the focus on top line revenue growth and market share gains among the tech darlings has propelled these stocks to extraordinary values.

In markets where the wind is at one’s back, these kinds of investments do extraordinarily well. But when the wind shifts as it has over the last three months and the economy slows, there is more focus on companies with more stable cashflows. Whether or not we are currently in a recession, expectations for dramatic high growth opportunities in technology or crypto finance or other sexy investment opportunities have diminished. This puts relatively more focus on cash-generating and defensive industries like collision repair.

Institutions with large pools of uninvested cash continually search for the right balance between risk and reward. How much risk should I take for how much reward? During the past five years with T-bills at very low rates, many value investors have been willing to accept relatively modest returns from more stable cash flow generating businesses. Collision repairers have decades of stable cash flow, albeit with gradually increasing investment requirements and declining numbers of participants.

So with such strong demand from consolidators old and new, now is a good time for collision repairers to find sponsors to help capitalize their future growth or consider exiting while the demand for acquisitions continues to be robust.

About Focus Advisors

Focus Advisors is the collision industry’s leading M&A firm representing MSOs and single shops. We help entrepreneurs create and realize equity value by advising, raising capital and helping them sell their businesses. Led by Managing Director David Roberts and his 25 years in the industry, he and his team of experienced professionals have closed more than 40 transactions, totaling more than 300 collision repair locations and $500 million in transaction value. For a confidential discussion about your future, your value, and the benefits of having an experienced advisor on your side, visit our website https://focusadvisors.com/contact/ or contact David Roberts at [email protected] or by calling 510-444-1173

Investment banking and securities offered through Independent Investment Bankers, member SIPC/FINRA. Focus Advisors and Independent Investment Bankers are not affiliated.