Owners of small MSOs and single shops are increasingly recognizing the most effective way to create more value in their businesses is to scale up – whether from a single shop into an MSO or from a small MSO into a larger MSO. It’s a proven playbook that hundreds of operators have executed over the last two decades. In this article we will review key industry segments and their growth trajectories. We’ll discuss how valuations for MSOs differ from single shops – and why. Then we’ll demonstrate with a more detailed example how the growth from a single shop to three shops generates multiples of value.

The Collision Repair Industry is Consolidating Everywhere.

The collision repair industry has been consolidating for two decades. While most collision repair shops (80% of total shops) are single locations, the fastest growing segments of the industry are large consolidators (12%) and Independent MSOs (8%).

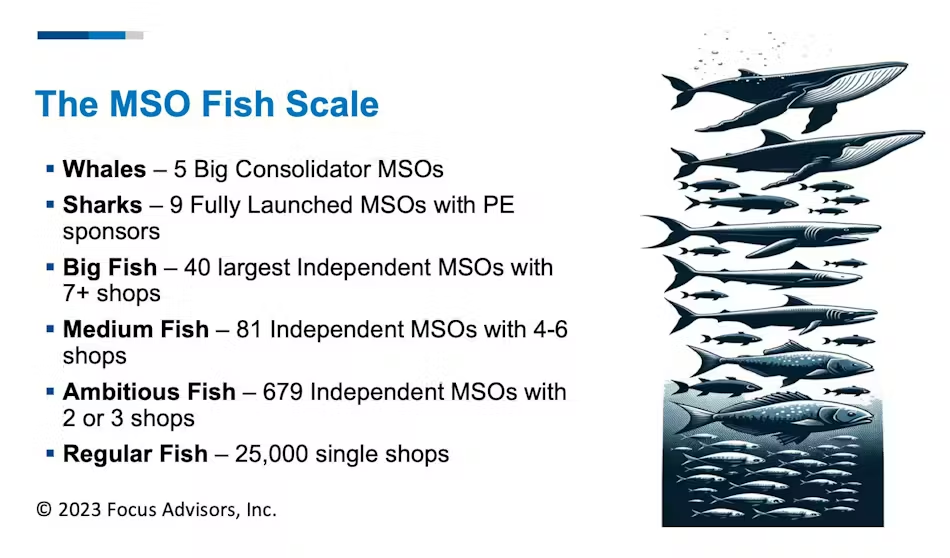

Focus Advisors has created a proprietary database that tracks all the MSOs and single shops throughout the country and categorized them into the “MSO Fish Scale”. Despite the headlines squarely focusing on the Big Five (the “Whales”) and the private equity-backed platforms (the “Sharks”) getting bigger and acquiring more shops, the data show that there are more than 800 independent MSOs (the “Big Fish, “Medium Fish”, and “Ambitious Fish”) that are scaling up and increasing wealth for their owners.

While the “Big Five” Consolidators – Caliber, Gerber, Crash Champions, Joe Hudson’s, and Classic Collision garner most of the publicity because of their relentless acquisitions and greenfield developments, independent MSOs are growing at similar rates – mostly under the radar.

These large Consolidators with the deepest pockets have been acquiring single-shops and MSOs at a relentless pace. In August 2018, for example, the Big Five had a combined total of 1,421 shops. By the end of 2023, the Big Five had more than double their shop counts to 3,517 shops. They collectively added over 2,000 shops in just five years – mostly through acquisitions.

In 2023, more than 550 shops were acquired or developed by consolidators and independent MSOs. Surprisingly about a third of this total were single shops growing to two-shop MSOs. Another third were acquisitions by existing independent MSOs enlarging their scale, and the remaining 38% were acquisitions or developments by the largest consolidators.

MSOs Command Higher Valuation Multiples than Single Shops

When someone is starting a business, or perhaps taking it over from an earlier generation, it’s probably not their first instinct to think about selling it one day. Whether an owner is planning to sell the business this year or a generation from now, it’s important to have an ongoing awareness of the business’s enterprise value. So understanding how lenders or acquirers value a business is critical to planning its growth determining its current and future value.

Clearly there are advantages to becoming an MSO. That’s explained by economies of scale. Larger MSOs gain an edge because they negotiate significantly better discounts on parts and paint, they can benefit from centralized software and corporate processes, they can hire talented regional managers, they have strong DRP relationships, and have greater name recognition. All of these are reflected in their financial performance; larger MSOs benefit from higher revenues, better gross profit margins, a lower expense ratio, and ultimately, greater EBITDA.

EBITDA is the cash generated by a business before paying taxes and interest on loans or reinvesting in growing the business. And it’s that EBITDA (earnings before interest, taxes, depreciation, and amortization) that truly turns on the value creation for a collision business.

So how is it that EBITDA drives value creation? Whether that value is being considered by a lender like a bank or an acquirer, they both look at its value in the marketplace. Even though a lender is more concerned about the likelihood of their loan being repaid, they still focus on the firm’s EBITDA.

Likewise acquirers evaluate the value of a business – whether their own or a potential acquisition – as a multiple of EBITDA. EBITDA helps them assess the fundamental earning potential of an acquisition. They then layer in their own unique cost structure, tax rates, and depreciation schedule. Acquirers arrive at the number they’re willing to offer by multiplying the business’s existing EBITDA by a certain multiple. And if you are the acquirer, you will pay attention to the same factors!

Acquisition multiples are influenced by several factors: the larger economy, the business’ market and physical location, its number of techs or certifications, the quality of its facilities, etc. Regardless of what exact multiple of EBITDA is used, the most important fact is that every dollar of EBITDA the business generates can create additional business value on the back-end.

From the Focus Advisors database of actual transaction values, it’s clear that MSOs are valued at higher EBITDA multiples than single shops. That means even if a single-shop and an MSO are generating the same revenue and EBITDA, the MSO will be valued more highly because buyers would offer a higher EBITDA multiple.

Why is this? Because it is more efficient for acquirers to pursue a larger business with more locations, stronger in-place management and systems versus acquiring several single add-ons. We’ve heard repeatedly from consolidators they’ll pay a premium for an MSO because from their point of view, a single shop often operates according to the owner’s individual philosophies, whereas creating an MSO forces owners to develop more standardized processes and systems. Buyers can’t replicate the success of an individual owner’s process, but they can more easily adapt the systems and processes of an MSO to their larger platform.

A Growth Comparison

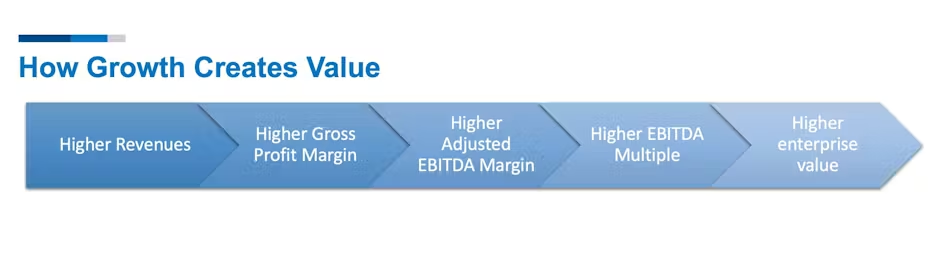

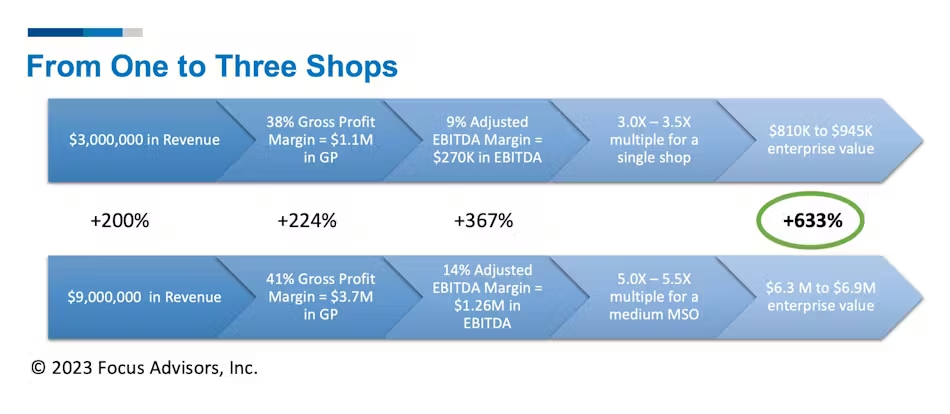

But it is also the case that MSOs – just given their size and enhanced profitability – also tend to have higher EBITDA in the first place. So they get the dual benefit of higher EBITDA combined with higher EBITDA multiples. The value creation mechanism looks something like this:

To illustrate this point, let’s say you are a strong operator with a single $3 million shop and are confident you can expand your footprint and build another $3 million of revenue in a new shop. This is much easier said than done, of course. It entails adding debt and risk and personnel challenges to name just a few. Further expansion from one to three shops is even more challenging. But observe how much value is created when this expansion is completed.

With the larger footprint, you are able to grow revenues substantially (200%). But with scale, the business itself should become more profitable. That’s because an MSO can command better parts discounts, labor rates, paint discounts, and can spread overhead expenses across more revenue. How is this so? Buying parts at 25% off instead of 22%, paint discounts increasing from 50% to 60%, spreading out the management costs, training, rent factors, insurance, marketing and a host of other small costs all add up to reduced overhead per shop.

In this example, we assumed that a $3 million single-shop might generate a 9% EBITDA margin, whereas a medium-sized 3 shop MSO might generate closer to a 14% EBITDA margin.

But look at the end of this chain. The major value creation for the market value of a business takes place through the higher EBITDA valuation multiples. A single shop might be valued at 3X to 3.5X EBITDA, whereas a medium MSO would realize a multiple closer to 5X to 5.5X. In other words, by increasing revenues by 200% (from $3 M to $9 M) an owner could ultimately grow the value of the business by around 633%. Many of our clients have been able to recognize this, implement a growth strategy, and achieve successful exits with similar results.

The Leap from a Single-Shop to an MSO

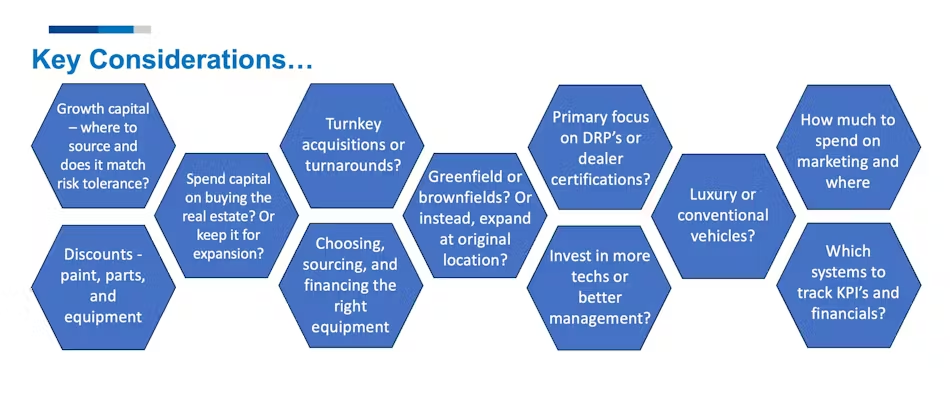

Collision repair is a very operationally intensive business. It’s hard enough to keep a single shop operating consistently well. But as an owner, if you are confident that you have optimized the operations of that first shop, it might be time to try to make the leap to another location. Here are some key questions to ask yourself as you embark on your growth plan: strategy:

There are numerous examples of collision repair entrepreneurs who have already gone down this path. These entrepreneurs each did two things: first, they locked down the performance in their first shop before they expanded further. And second, they only expanded once they had a growth playbook. The successful growth playbook was a multi-year strategy to adding shops to their footprint and it incorporated answers to the questions laid out above. As they executed on that plan, they accessed sufficient capital to expand, they trained up their managers, and they made sure their customers, whether DRPs or dealers or the general public, appreciated their increased scale, professionalism and capabilities.

Some have grown their MSOs and had successful exits, while many are still in business, continue to grow, and have no near-term plans of selling. What both groups fully understand is how larger-scale MSOs create outsized gains in their business’ value. Through growing their MSO, they both grew their EBITDA, but also grew their EBITDA multiple in the eyes of potential buyers.

In conclusion, scale is the key factor in creating a higher value for the business. We have seen dozens of such success stories in our time advising owners on growth strategies or in representing them in an exit. No story is the same; each one of these success stories has had a unique entrepreneur with a unique plan.

About Focus Advisors:

Focus Advisors (www.focusadvisors.com) is the collision industry’s leading M&A advisory firm, partnering with MSOs between $10-100M in annual revenue, helping owners achieve maximum value through strategic growth and exits. Unlike traditional business brokers or large investment banks, Focus Advisors specializes exclusively in collision repair — giving owners unparalleled insight into value, interest, and opportunity timing. With over 25 years in the industry, Managing Director David Roberts has led more than 40 transactions totaling over $500 million in transaction value and more than 325 collision repair shops, including Pride Auto Body, Quanz Auto Body, Mills Body Shops, and Master Collision Group.

Investment Banking Services and Securities offered through Independent Investment Bankers Corp. a broker-dealer, Member FINRA/SIPC. Focus Advisors is not affiliated with Independent Investment Bankers Corp.

This article by Madeleine Roberts Rich was originally published in Fender Bender on April 26, 2024. Here is the link for that article.