Driving Force Collision enters Pennsylvania with its acquisition of Tom Masano Collision Center

May 9, 2025: Focus Advisors, the leading M&A firm serving the collision repair industry, is pleased to announce the successful sale of Tom Masano Auto

Keep a finger on the pulse of collision repair with our insights straight to your inbox…

May 9, 2025: Focus Advisors, the leading M&A firm serving the collision repair industry, is pleased to announce the successful sale of Tom Masano Auto

In this episode of the M&A Master Podcast, host Patrick Stroth speaks with David Roberts, Founder and CEO of Focus Advisors, an M&A firm specializing in

View the PDF version of this article here: Year in Review The year 2024 posed some challenges for the collision repair industry, and single shops

If you’re looking to sell your shop(s), 2025 is shaping up to be a good year. Here’s what you need to know first. This podcast was originally

PORTLAND, OR December 20, 2024 – Puget Collision closed on its acquisition of Bob Thomas Auto Body, Inc., a high-performance and Tesla-certified collision repair shop

David Roberts, the founder and managing director of Focus Advisors Automotive M&A, presented the collision repair industry’s market update at this year’s MSO Symposium in

This article was originally published by Elizabeth Crumbly on Autobody News and is republished here with permission. Sellers are frequently reinvesting part of the proceeds into the business to

LOS ANGELES, CA, November 5, 2024 – Focus Advisors, a national automotive mergers and acquisitions advisory firm, reports that its client, Pacific Collision Equipment, has

On Monday, November 4th, Focus Advisors Founder and Managing Director, David Roberts, presented at the 13th annual MSO Symposium in Las Vegas on the state

What Private Equity Firms Should Look for in a Platform Acquisition In a recent conversation with a large private equity firm, we were asked to

This article was originally published by Elizabeth Crumbly on Autobody News and is republished here with permission. Sales of dealership collision centers pose multifaceted benefits, both

This article was originally published by Brian Bradley on Autobody News and is republished here with permission. The recent interest rate cut by the Federal

LANSING, MI, September 6, 2024 – Focus Advisors is proud to announce the sale of its client, Tripp’s Collision Centers, to CollisionRight, a regional consolidator. Tripp’s

https://vimeo.com/1003362987?share=copy Auto dealers are consolidating for many of the same reasons as collision repairers: retiring owners, scale economies, increased competition, higher operating costs, increased vehicle

SEATTLE, July 31, 2024 – Focus Advisors, a national mergers and acquisitions advisory firm, is reporting that the Seattle metropolitan area remains one of the

FALMOUTH, VA, June 14, 2024 – Since their private equity-backed inception in Atlanta, Classic Collision has recently started moving up the east coast, and as

Selling your collision repair business may only happen once in your life. It’s an opportunity many business owners don’t get — and a chance to reap

In the last five months, more than $9 billion in capital has been invested into the collision repair industry by private equity firms. The biggest chunk of this new capital was $4.6 billion in debt refinancing by Caliber Collision. Crash Champions also refinanced a significant piece of its debt and brought in an additional equity investment. Classic Collision, CollisionRight, VIVE Collision and Kaizen all found new sponsors. As the industry’s leading M&A advisor, we have thoughts and comments.

Owners of small MSOs and single shops are increasingly recognizing the most effective way to create more value in their businesses is to scale up

PHOENIX, February 12, 2024 – Last month, prolific industry veteran Jim Huard sold his latest successful venture, Painters Collision Centers, to Classic Collision. This exit

Consolidators, Accelerators and Independent MSOs remain undaunted in their pursuit of growth. In a year that saw interest rates more than double, shops rates and

DENVER, December 12, 2023: Focus Advisors, a national mergers and acquisitions advisory firm, who represented Colorado Auto Body in its sale last week and most

DENVER, December 13, 2023 – Focus Advisors, the leading M&A firm specializing in collision repair, is proud to announce the sale of Colorado Auto Body

The Big Collision Repair Consolidation: Past, Present, and Future Industry Trends The collision repair industry has experienced dramatic consolidation over the past 25 years, transforming an

DENVER, November 13, 2023 – Focus Advisors, the leading M&A firm specializing in collision repair transactions, is proud to announce the sale of three collision

For an increasing number of single shops and small MSO operators, the frequent and emphatic conclusion is “I’m done. I’m getting out.” Why now? What’s

May 26, 2023 – Focus Advisors, the leading M&A firm in Collision Repair, is proud to announce the successful sale of Vinart Dealerships’ body shop

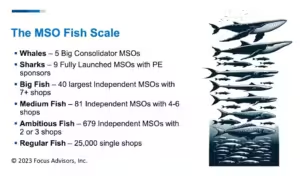

Scale is paramount to performance in the consolidation of the $36 billion collision repair market. Private equity provides the fuel that accelerates the consolidation. And

The acquisition and development strategies of key consolidators have come more sharply into view during 2022. The Big Five deepened and diversified their offerings. The

December 16, 2022 – Focus Advisors, the leading M&A firm specializing in collision repair transactions, is proud to announce the sale of CARSTAR Highland in Denver

This article was published by Autobody News on October 11, 2022. Here is the link to the article. Focus Advisors, an M&A firm specializing in

Who has time for conferences? You may not, so that’s why we went instead. Over three days of sessions and networking, we covered a lot

Here at Focus Advisors, we’ve represented body shop owner operators in their sale to buyers for dozens of transactions. From that experience, we know there

A sale of your shop may seem like a long way off, but it doesn’t hurt to start thinking about what the process looks like,

After months of speculation about the future of Service King, a blockbuster merger was announced to Service King managers last Friday. The two consolidators will

David Roberts, Managing Director of Focus Advisors (focusadvisors.com), comments on the many acquisitions and openings in the first half of 2022. Originally a co-founder of

Collision repair has often been called the ugly stepchild of a dealer organization. Some dealers, though, have made collision repair the stars of their organizations.

Recently, the Investment Banking Team at Focus Advisors sat down with some key industry leaders and posed a number of provocative questions about pressing issues. Over the course of many hours, these deeply experienced entrepreneurs shared their own thoughts, opinions and principles on which they are growing their businesses. Below we share brief comments from each of them.

With 2021 now in the rearview mirror, the industry is catching its breath after a year of sprinting that saw extraordinary acquisition activity.

December 21, 2021 – Focus Advisors, the leading M&A firm specializing in collision repair transactions, is proud to announce that its client, Quanz Auto Body of Albuquerque, NM, has been acquired by Crash Champions

“We wasted a lot of time trying to sell our MSO by ourselves. And if we had succeeded, it would have cost us millions of dollars trying to save a few hundred thousand on fees. Talk about pennywise and pound foolish – that was.”

While repair demand has never been higher for most well positioned providers, technician shortages have never been worse. Parts costs are rising rapidly and cycle times are growing longer. Revenues and profits have been slow to recover for most collision repairers – whether large or small.

Comments and observations after a week in Las Vegas at the MSO Symposium, CIC and SEMA

The time for straight talk about selling is long overdue for many owners. No matter how much people want to avoid the specifics of leaving

Article by David Roberts featured in FenderBender’s October 2021 issue Remember Labor Day 2016 – five years ago? The recession was in the rear-view mirror.

October 1, 2021 – Focus Advisors, the leading M&A firm specializing in collision repair transactions, is proud to announce the sale of two shops to

October 1, 2021 – Focus Advisors, the leading M&A firm specializing in collision repair transactions, is proud to announce the sale of eight shops to

Gerber’s recent acquisition of Collision Works (CW) is the largest acquisition of an independent MSO in the last three years. Combined with the acquisition of

How much attention do you pay to those ever-present gray vans emblazoned with the Amazon logo? Did you ever stop to think who owns them?

Resilience and Realization – Two different responses to the COVID pandemic In dozens of discussions with shop owners over the past four months, there is

The year that was and the year to come. Can anyone imagine a more incredible and challenging time? First Quarter 2020 was a record quarter

Four significant acquisitions in the last six months are emphatic evidence of the momentous changes in the largest collision repair market in the US –

It’s August 2020 and we are more than halfway through a most extraordinary year. The Great Pause continues. What follows is our midyear update. As

With the pandemic depressing collision business performance and providing uncertainty, why are buyers more plentiful and active than ever?

Managing Director, David Roberts, was featured in an article originally published by Autobody News on July 13, 2020. Here is the full article from Autobody News.

Published in Autobody News April 27, 2020 Written by Stacey Phillips David Roberts, managing director of FOCUS Advisors, Inc. With Driven Brands‘ purchase of Fix Auto USA and Auto Center

David Roberts, Managing Director of FOCUS Advisors (focusadvisors.com), comments on the year just ended and expectations for 2020.

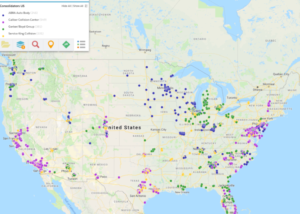

By 2030 there will be 15,000 shops in the US: 4,000 in third tier cities and rural areas 2,000 will be franchisees 9,000 in the

We often write about how consolidation is constantly creating new landscapes in the collision repair industry, one increasingly dominated by the largest MSOs. At the

Rumors have circulated for years that Cook’s Collision “was putting itself on the market,” “was about to be sold,” “has been sold,” etc. Given the recent

The pronounced shift in consolidator focus from platform acquisitions to brownfields, greenfields and single shops has opened the door for regional and multi-regional MSOs to

The first six months of 2018 are now in the rearview mirror, NACE is rapidly approaching, so we at FOCUS are taking a few moments

Amidst all the change and turmoil in the collision repair industry, the success of some of the fastest-growing MSOs is being driven by impressive young

Twenty-two years ago, David Roberts was the Chairman of the Board for Caliber Collision Centers, Inc. when he wrote an article in Autobody News. The article, titled “Shop Consolidation, Is

For the last 5 years, Focus Advisors and other industry observers have been reporting on a continual increase in Consolidator acquisitions. Looking back at the

© 2024 Focus Advisors Automotive | Designed by JSL Marketing & Web Design

Investment Banking Services and Securities offered through Independent Investment Bankers Corp. a broker-dealer, Member FINRA/SIPC.Focus Advisors is not affiliated with Independent Investment Bankers Corp.

Trademark Disclaimer:

All trademarks, logos and brand names are the property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, trademarks and brands does not imply endorsement, sponsorship or affiliation.